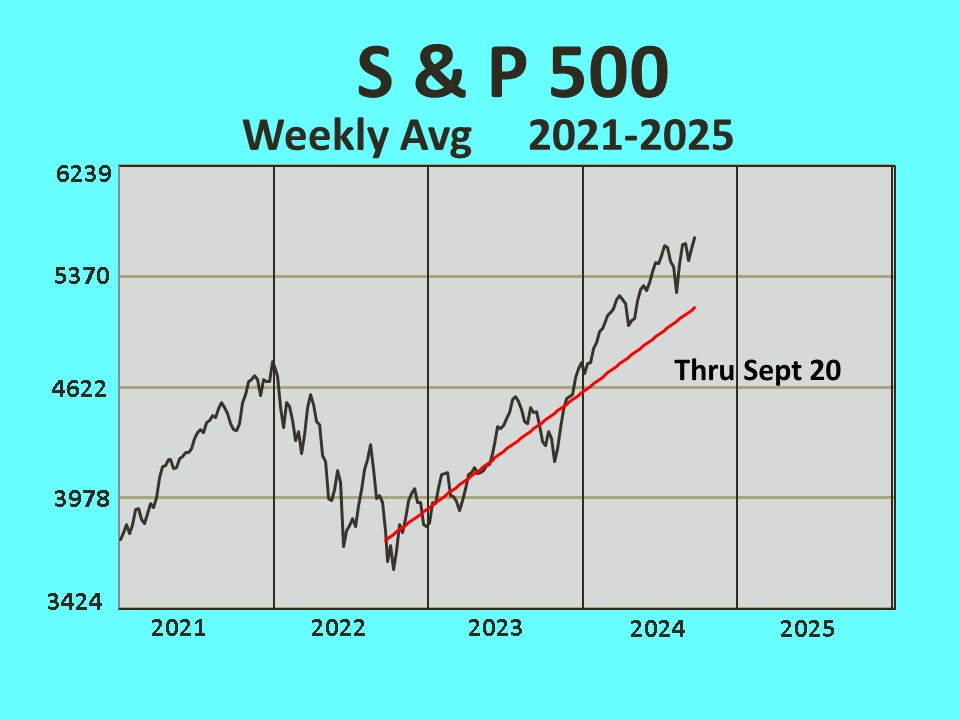

WEEKLY STOCK PRICES VERSUS TREND

The country

was hit in February 2020 by the pandemic. For the rest

of the year the economy was in the doldrums as it coped with

lockdowns, work at home, and other restrictions demanded by

the covid virus The economy and society returned to

normal in 2021 but that all changed drastically in January

2022. Consumers had to adjust their spending due to

extremely high inflation. The Federal Reserve began to raise

interest rates aggressively. Stock prices dropped into bear

market status.

The country

was hit in February 2020 by the pandemic. For the rest

of the year the economy was in the doldrums as it coped with

lockdowns, work at home, and other restrictions demanded by

the covid virus The economy and society returned to

normal in 2021 but that all changed drastically in January

2022. Consumers had to adjust their spending due to

extremely high inflation. The Federal Reserve began to raise

interest rates aggressively. Stock prices dropped into bear

market status. The bear market ended in October 2022 and since then the economy and stock market started recovering. Even as stock prices moved erratically up and down they appeared to be in a trend from October '22 through all of 2023 into early '24.. (The trend shown on the chart was fit to data from mid September '22 to mid May '23. It has a rate of 16 percent per year). This was the initial rate of recovery from the bear market.

Since the end of 2023 the weekly average through September 20 has increased by 18% and is 10% above the trend line. The initial trend as recovery from the bear market started has clearly been exceeded now reflecting strength in the economy. However, the 18% gain so far is equivalent to a 25% annual rate. For that rate of gain to continue much longer is not realistic.

Even so there are many positives in the outlook. The economy has settled into a soft landing. Consumer and producer inflation continues to slowly recede. The labor market is slowing but is still positive. Earnings have remained favorable. The Federal Reserve is likely to cut rates another half point before year end and perhaps another full point next year. On the whole most factors are favorable for continued advances in stock prices. However, as experience has made known to us, unforeseen factors can upset a trend. In early August an implosion in the Japanese stock market rippled through all the stock markets around the earth. There are two very dangerous wars underway. A number of abnormal weather disasters have occurred. Also we have a national election in November. The impact of the result on the economy and stock market is anyone's guess.

Robert O. Welk